|

|

/Home / Info / Acronyms

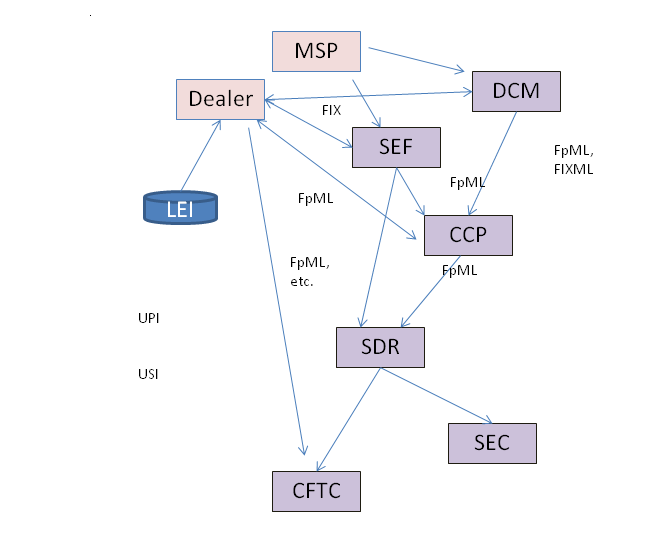

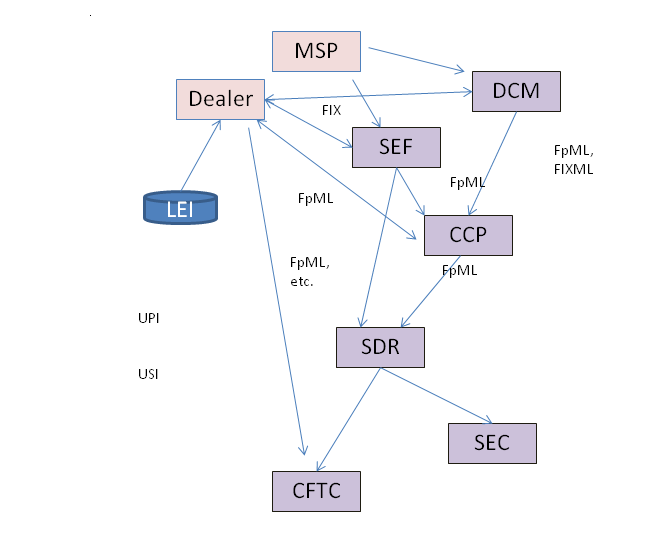

Regulatory Acronyms and FpML

The US Dodd-Frank Act (DFA) has introduced a myriad of new players and processes to OTC derivative trading. Here is a quick

guide to some of those acronyms, and how FpML and other standards relate to them. Please mouse over the different acronyms

to see an explanation (IE, Firefox, or Chrome), or scroll down to see a list of all of the explanations (and to find links).

- FpML - Financial Products Markup Language. FpML is the XML e-commerce standard for privately negotiated derivatives. It is maintained by ISDA, the International Swaps and

Derivatives Association. FpML was launched originally by JPMorgan, and Brian Lynn, GEM's founder, helped to establish the

organization for JPM and chaired the FpML Standards Committee while he remained there.

- SD - Swaps Dealer. This is an organization that makes 2-way markets in OTC derivatives. A precise definition is still pending approval. Examples will probably include major broker/dealers such as JPMorgan, Goldman Sachs, Morgan Stanley,

etc., as well as a number of smaller dealers. It may also include some hedge funds or other buy side firms that act as dealers.

- MSP - Major Swaps Participant. This is an organization that actively trades in the swaps market, but generally as a component of an investment or hedging

strategy. A precise definition is still pending approval. Examples will probably inclue major investment managers like PIMCO and Wellington.

- SEF - Swaps Execution Facility. This is a regulated entity that allows OTC derivative market participants to trade with each other. This will probably

include many offerings, including ones from existing swaps trading plaforms like TradeWeb and MarketAxxess, as well as possibly

offerings from exchanges (e.g. CME, ICE), market data vendors (Bloomberg, Reuters), interdealer brokers (e.g. ICAP, Tullett

Prebon), etc., etc.

- DCM - Designated Contract Market. This is a regulated entity that permits trading in certain standardized contracts, typically such as futures and listed

options. Some may also allow trading in OTC derivatives. Examples include offerings from CMEGroup, ICE, etc.

- DCO, DCE - Derivatives Clearing Organization/Entity. This is an organization that minimizes a derivatives market participant's counterparty risk by centralizing and mutualizing

it. Each derivative contract between two counterparties is cleared by replacing it with two contracts, one between party

A and the clearing house, and an equal and offsetting contract betwen the clearing house and party B. Cleared derivatives

are revalued daily and the clearing member is required to post collateral/margin for net out of the money exposure. Examples

are likely to include offerings from firms such as LCH (London Clearing House) and CME Group, ICE, as well as likely others.

- CCP - Central Counterparty. Same as a DCO. So called because of the way that the DCO steps in between the other counterparty and acts as a central

counterparty. See "DCO" for more information.

- SDR - Swaps Data Repository. This is a central industry utility set up to allow swaps dealers and major swap participants to report to regulators in

a single uniform way. The principal SDR will likely at first be the trade repository offering from DTCC, but others may be

developed in the future. See below under "SDR Reporting" for key regulations and standards affecting SDRs.

- UPI - Universal Product Identifier. A (not yet defined) identifier that will describe the characteristics of the type of product that is traded (but not the

transaction specific information). For example, it will include items such as the product structure (e.g. swap/option/forward),

underlying index and currency, but not terms such as the size (notional) and price (fixed rate). ISDA is working on the definition

of this, but it is difficult to introduce to an over the counter market with non-standard trades.

- USI - Universal Swap Identifier. A (not yet defined) identifier that will uniquely identify a specific swap contract. A trade ID that is known across multiple

organizations.

- LEI - Legal Entity Identifier. An identifier to be allocated by a planned service that will uniquely identify a legal entity that can be involved in a

financial industry transaction, such as a swap. Requirements for the LEI are being defined by several industry associations

led by SIFMA. A consortium of DTCC and SWIFT will likely develop the LEI system.

- CFTC - Commodity Futures Trading Commission. The US regulator charged with monitoring OTC derivatives that are based on commodities or indexes. This includes interest

rate derivatives, index CDS, commodity derivatives, etc.

- SEC - Securities and Exchange Commission. The US regulator charged with monitoring OTC derivatives that are based on securities. This includes single name credit

default swaps, single stock equity derivatives (e.g., total return swaps and OTC equity options on a single security) and

some other products (e.g. OTC bond options.)

- Dealer-CFTC reporting. Swap dealers will be reporting some information directly to regulators like the CFTC. One example is the Part 20 commodity large trader report. GEM's Brian Lynn is chairing the ISDA Commodity Reporting Working Group developing FpML for this report. The key message is the "exposureReport", to be included in FpML 5.3, released in the fall

of 2011.

- DCO interaction. Swap dealers and execution facilities frequently need to interact with central counterparty derivatives clearing organizations

(DCO's or CCP's) to request a trade to be cleared, to grant consent for the trade to be put on, and to obtain status about

trades that have been cleared. FpML is used by a number of the CCPs, including CME and LCH (London Clearing House). The

FpML messages to support this are defined in the FpML Business Process Working Group (BPWG), which is chaired by GEM's Brian Lynn. Key FpML messages include requestClearing, requestConsent, clearingStatus, and clearingConfirmed.

- SDR reporting. Organizations such as Swaps Exchange Facilities (SEFs), Central Counterparties (CCPs), and Swaps Dealers must report trading

activity to Swaps Data Repositories, to meet regulations such as the CFTC's 17 CFR Part 43 and 17 CFR Part 45 and the SEC's 17 CFR Part 240. Key SDRs such as DTCC are using FpML to support this reporting. The FpML messages to support this are defined in the

FpML Regulatory Reporting Working Group (RPTWG), which is chaired by GEM's Brian Lynn. Key FpML messages include the publicExecutionReport and the nonpublicExecutionReport.

|

|

|

|

| Top Headlines |

| Sept, 2011 -

GEM and Sapient Ally

GEM and Sapient have allied. See Partners for more information.

|

|

| Sept, 2011 -

GEM publishes an overview to financial reform acronyms

GEM has published a diagram and description of key acronyms related to financial regulatory reform, and how these relate to

FpML. See Acronyms for more information .

|

|

| July, 2011 -

FpML 5.2 WD#2 Includes GEM Contributions

FpML 5.2 focuses on clearing and public price reporting enahancements. GEM's Brian Lynn chairs the FpML Reporting and Business Process

Working Groups, which are charged with key aspects of FpML's response to Dodd-Frank regulations. See People for more information about Brian.

|

|

|